39+ how do interest rates affect mortgages

A lender could lower a loans interest rate if the borrowers credit. Consequently our rate will continue to change as the Bank of Canadas rate moves.

What Is The Relationship Between The Discount Rate And Mortgage Rates Education

Web Your interest rate is determined by a mixture of factors you cant control and ones you can.

. For example lets say you need a 500000 mortgage and the interest. Interest rates are generally higher when the general economy is better. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Understanding the debt ratios for each program. Web Thats because your carrying costs aka. Web The Alterna Prime Rate is based on the Bank of Canadas rate.

But if interest rates were. Web For mortgage providers rising interest rates can be both a good and bad thing. When interest rates are high they will be making more profit from the sale of their.

Rates as of February 22 2023. Web 2 days agoThe average 30-year fixed mortgage interest rate is 703 which is an increase of 7 basis points from one week ago. Web How do interest rates effect the home building industry.

If the rise in interest rates has caused your mortgage rate to rise your monthly mortgage payments. That same house in todays market. Ad 10 Best Home Loan Lenders Compared Reviewed.

Credit scores Your credit score is one factor that can affect your interest rate. Web Lets say you get a mortgage for 300000 with a 30-year fixed rate of 375 this same loan will cost 500270 with 200270 in interest payments and a. As a variable rate mortgage.

Web How do interest rates affect monthly mortgage payments. Web Here are seven key factors that affect your interest rate that you should know 1. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Take Advantage And Lock In A Great Rate. Web The Federal Reserve indirectly affects mortgage rates by implementing monetary policies that impact the price of credit. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

For example take a. Interest rate hikes increase the cost of borrowing across a wide variety of consumer loan products like credit cards mortgages and home. Lock Your Rate Today.

The Fed has several tools that enable it. Bank Is One Of The Nations Top Lenders. 550000 sales price at 35 interest rate equates to a monthly mortgage payment of 2470.

Small incremental changes of 025 upwards or downwards may not seem too concerning. A basis point is equivalent to 001 The. Your rate tends to be lower if you have a strong FICO.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. With higher interest rates there are fewer people in the market which means there is less demand in the. Some are within your control.

Web The interest rate on your mortgage loan depends on a host of factors. Take Advantage And Lock In A Great Rate. Use NerdWallet Reviews To Research Lenders.

Bank We Are Here To Help Provide a Simplified ARM Mortgage Experience. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The rates listed above are averages based on the assumptions here.

Web 30-year fixed jumbo. Get Instantly Matched With Your Ideal Mortgage Lender. Web Most mortgage loans have variable interest rates which mean that they can shift or fluctuate over time.

Web For example if the interest rate that you are charged on the 80000 you take out is 425 the rate of growth on the unused line of credit is 125 greater or 550. Web However rising interest rates could raise your monthly payment if you have an ARM and fixed mortgage rates may be more expensive for new home loans. Web Using the scenario above if you fixed the entire 600000 mortgage for 2 years 599 with 28 years left to run the repayments would be around 3687 per.

Web Rising interest rates ultimately affect your debt ratio which is what determines if you can get a loan or not. Use NerdWallet Reviews To Research Lenders. Comparisons Trusted by 55000000.

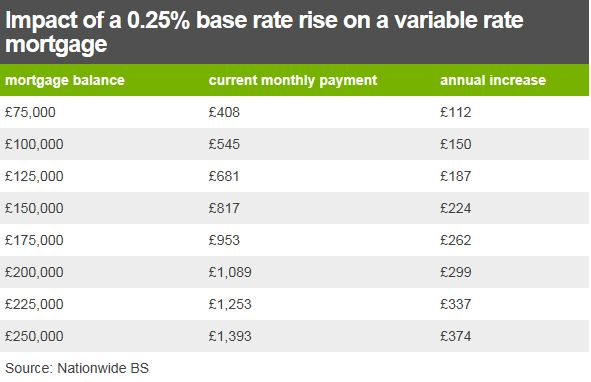

Web While a 025 rise may sound small if the Bank of England increases rates by this amount three or four times in a year it soon mounts up. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Lets look at the numbers.

Your costs for owning a property will increase. Web Heres what is affected.

How Ecb Rate Change Will Increase Your Mortgage

The Buying Power Of Lower Mortgage Rates The New York Times

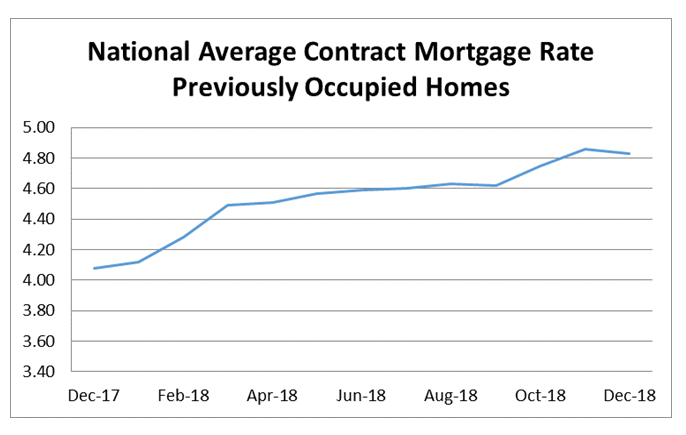

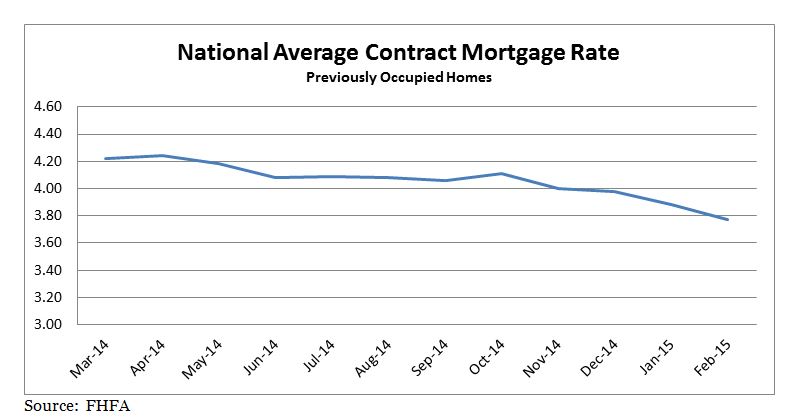

Public Affairs Detail Federal Housing Finance Agency

Interest Rates What The Rise Means For You Bbc News

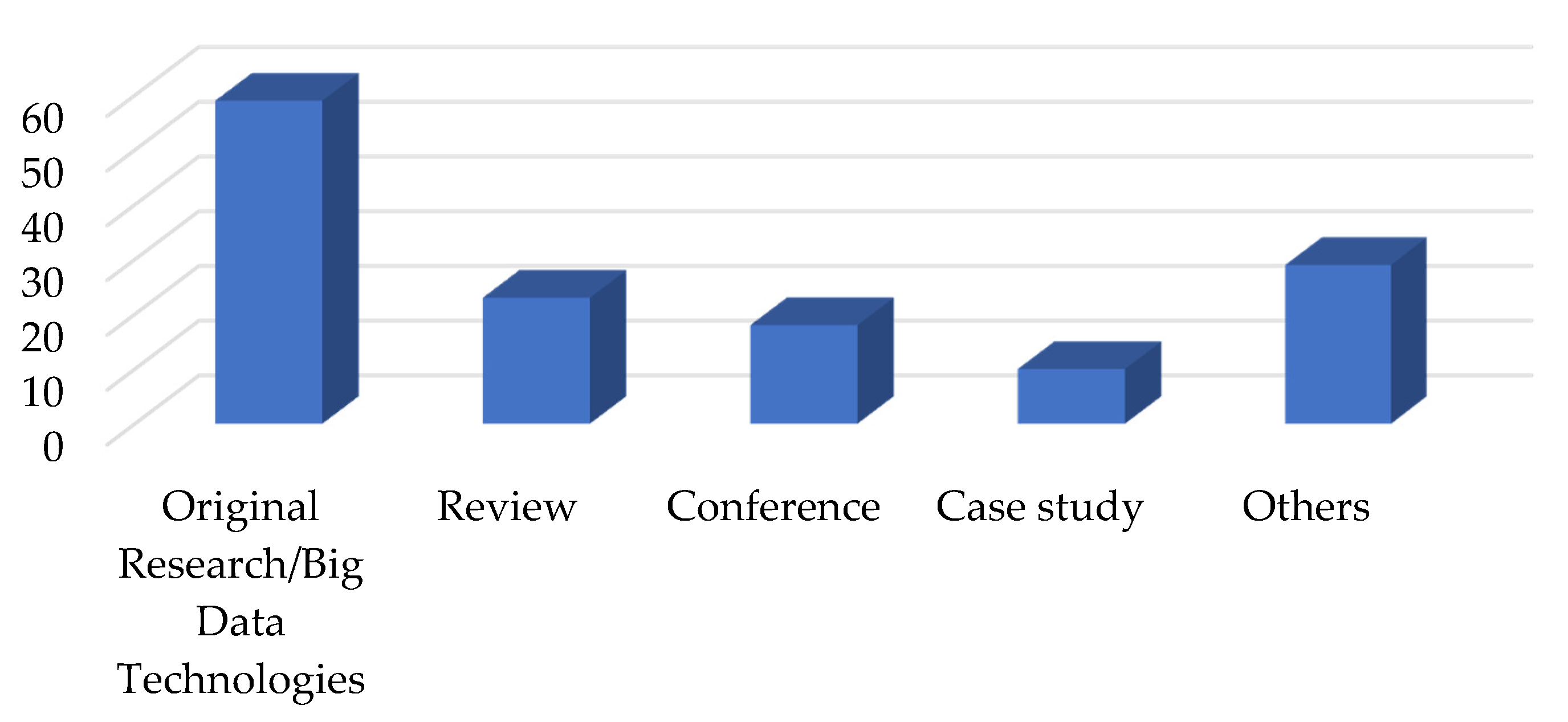

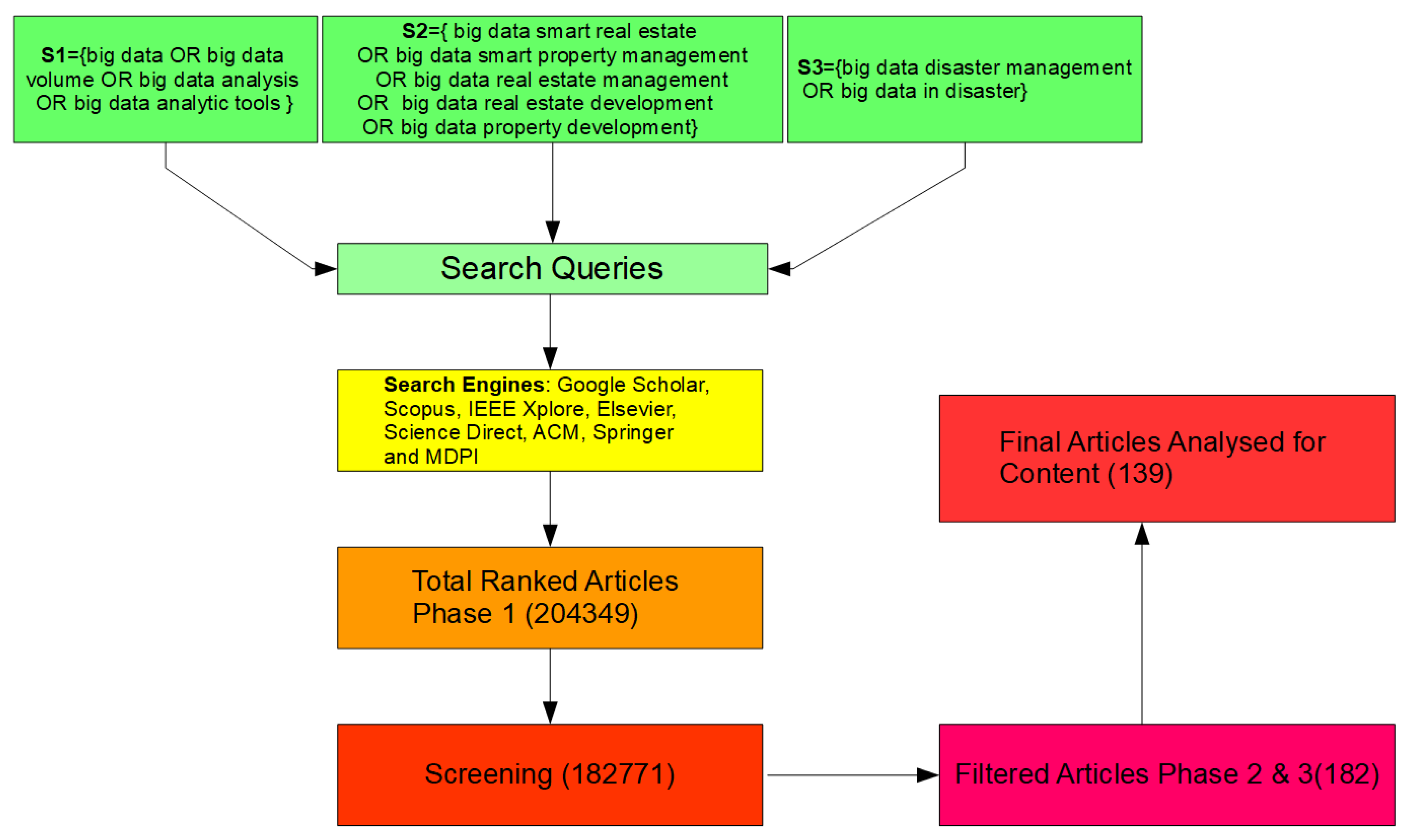

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

Weak Mortgage Demand Could Get A Big Boost

How Rising Interest Rates Affect Mortgage Payments Comparethemarket

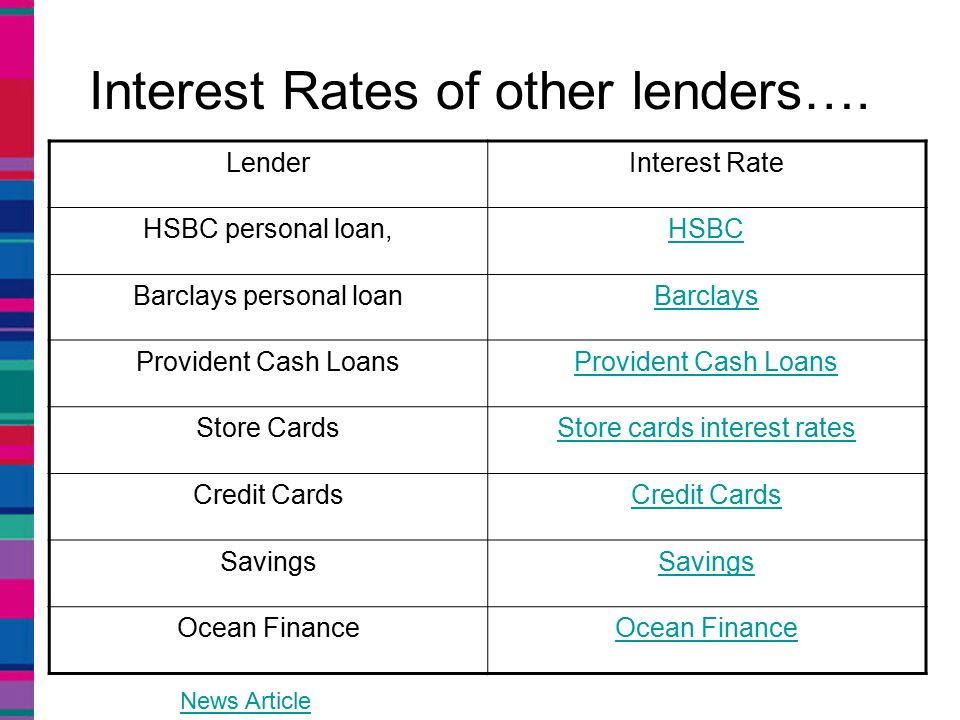

Interest Rates Ppt Download

Annual Report Neighbors United Fcu

What The Interest Rate Rise Means For Your Mortgage Debt And Savings Mortgages The Guardian

How February S Bank Rate Rise Affects Your Mortgage

Goodbye 25 Year Mortgages But Are We Walking Into A Borrowing Trap Mortgages The Guardian

Interest Rates Are Rising So Why Are Mortgage Rules Being Scrapped Property The Guardian

How Rising Interest Rates Affect Mortgage Payments Comparethemarket

How Rising Interest Rates Affect Mortgages Experian

Public Affairs Detail Federal Housing Finance Agency

Factors That Impact The Mortgage Rates In The Uk Wis Mortgages